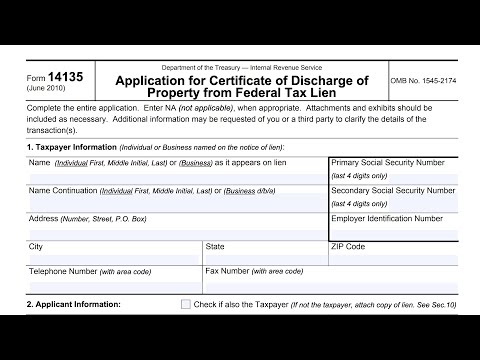

Video we'll be going over IRS Form 14135 application for certificate of discharge of a property from a federal tax claim as you know this is not the only way that taxpayers may get out from under a federal tax lien there are actually a couple of other options that might be available you can apply for a tax lien subordination you can apply for a withdrawal of of the tax lien itself and by filing form 14135 you can apply for a certificate of discharge so you might have to talk to either your tax professional or to the taxpayer advocate office to determine if this is the correct option for you but in this video we'll simply go over the mechanics of this form as if this has already been decided and then we can talk about there's some options you might have available to you so this is a fairly straightforward form it's three pages uh in in part one the taxpayer information if you're a individual you'll put your name uh first first name middle initial and last name if you're a business owner then you'll put the business name on on the taxpayer Information Form it depends on how how this appears on your lane so make sure you pay you have a copy of the lien and and everything that you're putting into this information field is as it reads from the lean notice so your primary social security number if you're married then your spouse's social security number would go in the secondary uh block and then if you're filing for a business and you have an employer identification number you would enter that followed by your address city state and zip code and telephone number and fax number in item two you'll...

Award-winning PDF software

How to prepare Form 14135

About Form 14135

Form 14135 is a taxable recovery program document issued by the Internal Revenue Service (IRS) in the United States. It is also known as the Application for Certification of Qualified Taxpayer Funds and Reimbursement of Costs. This form is primarily required by taxpayers who have been victims of financial fraud or scams and have been awarded restitution payments. This form authorizes the IRS to review and certify the amount of the recovery of money paid to the taxpayer to determine if it needs to be reported as taxable income. In summary, if you have received funds as restitution for financial fraud, and you want to confirm if the money is subject to taxation, you need to fill out Form 14135 and submit it to the IRS.

What Is 14135?

Online technologies allow you to organize your document management and strengthen the efficiency of the workflow. Observe the brief information in an effort to fill out Irs 14135, stay away from errors and furnish it in a timely manner:

How to complete a IRS Form 14135?

- On the website containing the form, click on Start Now and go towards the editor.

- Use the clues to fill out the relevant fields.

- Include your personal data and contact data.

- Make certain that you choose to enter suitable information and numbers in correct fields.

- Carefully examine the written content of the document so as grammar and spelling.

- Refer to Help section in case you have any issues or contact our Support team.

- Put an digital signature on the Form 14135 printable while using the support of Sign Tool.

- Once blank is completed, click Done.

- Distribute the ready blank by using email or fax, print it out or download on your gadget.

PDF editor enables you to make modifications to the Form 14135 Fill Online from any internet linked gadget, customize it in accordance with your needs, sign it electronically and distribute in several means.

What people say about us

How to fill out templates without having mistakes

Video instructions and help with filling out and completing Form 14135