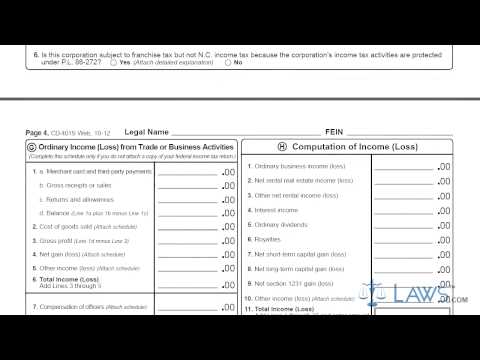

Laws dot-com legal forms go Form CD 401 S corporation tax return. North Carolina S corporations use a Form CD 401-S to file their state tax return. This document can be obtained from the website of the North Carolina Department of Revenue, step 1. Enter the fiscal year starting and ending dates for which you are filing if not filing on a calendar year basis, step 2. Enter the legal name of your business, its address, your tax identification number, your gross sales, and total assets per balance sheet. Fill in the ovals next to the statements describing your type of company and the type of return being filed, step 3. In Section A, follow instructions to compute your franchise tax, step 4. In Section B, follow instructions to compute your corporate income tax due as well as any refund owed, step 5. In Section C, document your capital stock surplus and undivided profits as instructed, step 6. In Section D, document your corporation's investments in tangible property in the state, step 7. In Section E, document the appraised value of this tangible property, step 8. In Section F, add all miscellaneous questions as directed, step 9. In Section G, compute your ordinary income or loss from trade or business activities as instructed, step 10. In Section G, compute income or loss as instructed, step 11. In Section I, compute adjustments to your income or loss as instructed, step 12. If you are filing an amended return, you must document all changes in Section J. If there is not sufficient space to complete your explanations, more is provided on page 8, step 13. Document shareholders' pro rata share items in Section K, your balance sheet per Books in Section L, your non-apportionable income in Section N, and your apportionment factor...

Award-winning PDF software

cd-14135 Form: What You Should Know

A. Use a computer to print a copy of Form 14135 and b. Use a computer to print and sign this form at the bottom. Filing Fee The filing fee to request an exemption for a federal tax lien is 100.00 per exemption for each year up to 30 years for which a lien is valid. (42 U.S.C. § 1321(k), sec. 1321(k)(5)(D).) An additional 50 must be added for each year for which a lien is valid. Tax year 2025 and later tax returns that have a lien listed on them must be filed using the Form 706, Uncollected Tax. This form is available on this site at any time, and can be mailed to the address shown below for a charge of 15.00 per return. The form is for use only by United States Citizens or Lawful Permanent Residents only. No one is exempt from the payment of all or the part of a federal or state tax due, the validity of such exemption shall not be affected, and no claim, appeal, or proceeding shall be maintained as to any amount assessed by any agency or other instrumentality. (Sec. 1321(k)-(L) Pub. L. No. 107-40.) Forms and Manuals Form 14135 (revised July 13, 2010) was published in the Federal Register on August 1, 2010. This form is the most accurate and current form available for the use of federal and state agencies, other government agencies, and tax practitioners to review and issue exemptions from federal taxes for tax debt. The form is a paper form, requiring paper-and stamp receipt by all entities involved in the issuance of a tax lien. This form is issued by the IRS. The tax lien was issued on or prior to July 13, 2010. The form has been revised to incorporate changes in the laws that came into effect prior to July 13, 2010, and in the regulations issued by the IRS in advance of these changes. The new form is available on this site and should be faxed or typed so that it is sent via the U.S. Postal Service. If the form is issued electronically, then the computer needs to print or otherwise generate copy of the form in its entirety.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14135, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14135 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14135 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14135 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form cd-14135